IIG (International Insurance Group)

We streamlined IIG Insurance’s workflows with AI-powered document handling, centralized data, and one-click carrier quote retrieval.

Requirements

IIG Insurance needed to eliminate manual data entry, streamline PDF template handling, and reduce delays in retrieving quotes from multiple carriers. The goal was to create a centralized, automated system that could handle customer data efficiently.

Overview

IIG Insurance was struggling with inefficiencies in customer data management and carrier quote generation. Their processes relied on heavy manual data entry, repetitive workflows, and fragmented systems. This led to frequent errors, delays in retrieving quotes, and a slow onboarding experience for customers.

To address these challenges, we designed and implemented a fully automated workflow that streamlined document processing, centralized data management, and simplified quote retrieval across multiple carriers.

Key Challenges

Manual Data Handling

Customer details were collected in raw, unstructured formats.

Each PDF template required repetitive manual entry.

System-generated PDFs lacked integration into existing templates.

Fragmented Quoting Process

Agents manually logged into multiple carrier systems to fetch quotes.

The process was prone to delays if agents were unavailable.

Limited Automation & Scalability

Bulk uploads (e.g., driver details from Excel) required repetitive work.

No centralized repository for customer data across workflows.

The Solution

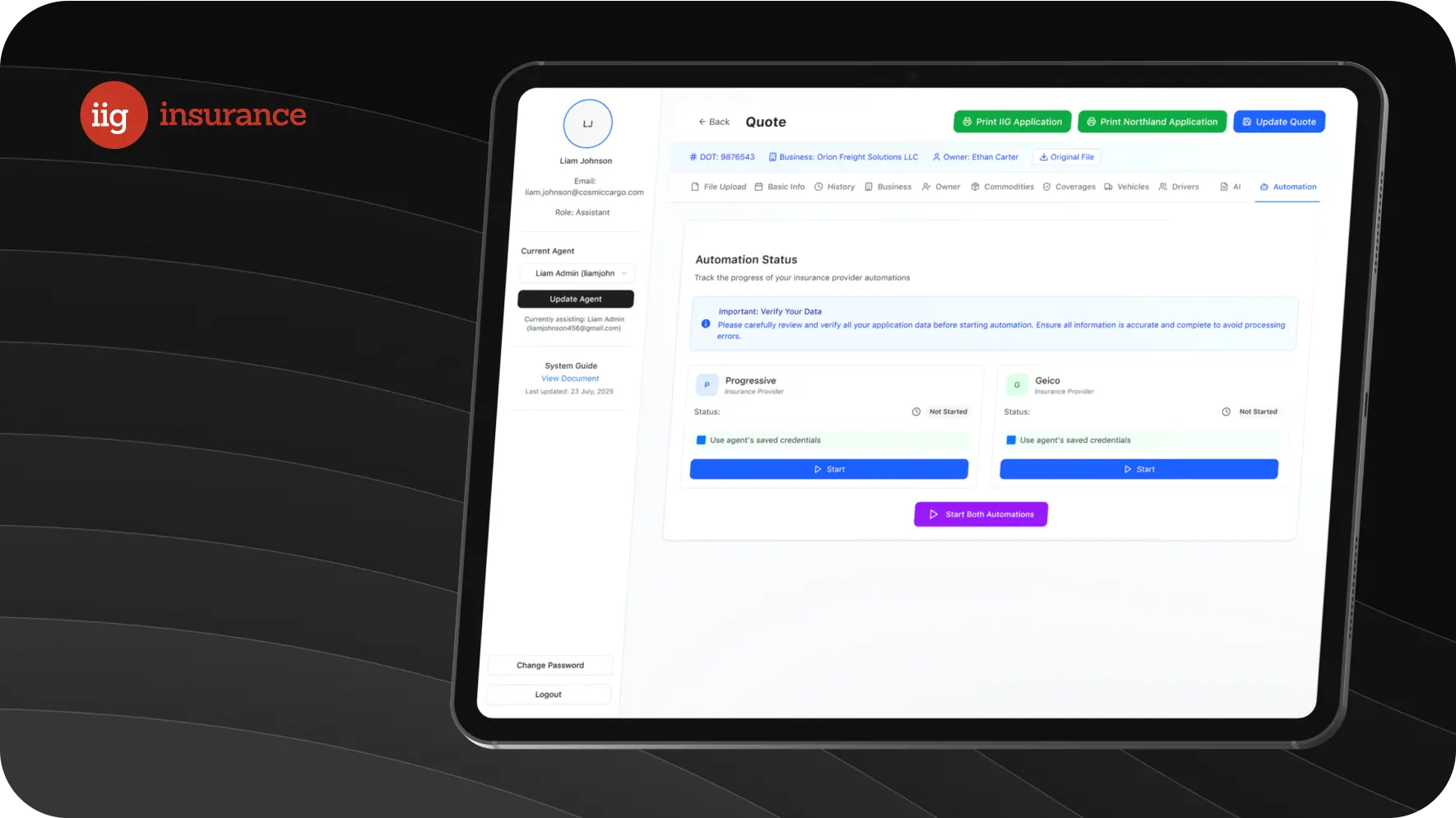

We developed a custom automation system that transformed IIG Insurance’s operations into a seamless, centralized, and scalable process:

Smart Document Processing

Used Azure OpenAI APIs for AI-powered document analysis to extract structured customer data.

Automated population of multiple PDF templates with zero manual entry.

Integrated advanced parsing and writing libraries to directly generate editable and printable documents.

Centralized Data Repository

Built a secure Azure portal as the single source of truth for customer data.

Enabled seamless integration of templates, auto-generated documents, and Excel uploads into this repository.

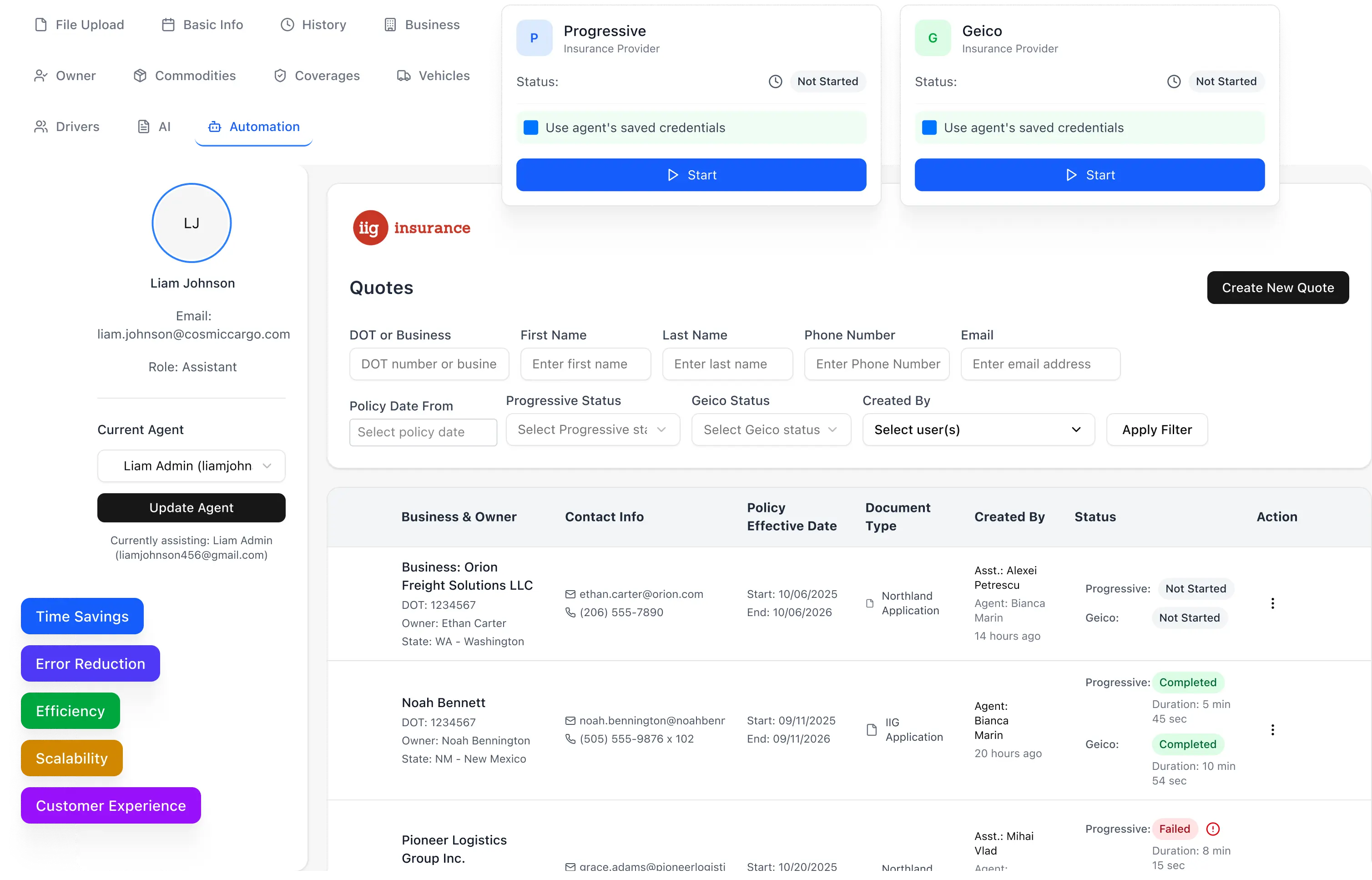

One-Click Carrier Quote Retrieval

Developed a unified quoting system to fetch quotes from multiple carriers instantly.

Eliminated the need for agents to log in to multiple carrier portals.

Bulk Data Handling

Added support for uploading Excel sheets containing multiple driver records.

Automated template population for batch data without human intervention.

Technologies Used

Frontend

Next.js

Backend

Django REST Framework

Document AI

Azure OpenAI APIs

Automation & Testing

Playwright

Data Storage

Azure Portal

PDF Handling

Advanced parsing and writing libraries

Business Impact

Time Savings

Document preparation reduced from hours to minutes.

Error Reduction

Automated data entry significantly minimized mistakes.

Efficiency

Agents can now generate carrier quotes instantly.

Scalability

Handles both individual and bulk customer data seamlessly.

Customer Experience

Faster onboarding and accurate quotes improved client satisfaction.

Conclusion

By automating IIG Insurance’s document and quoting workflows, we eliminated manual inefficiencies and created a centralized, intelligent system. This transformation not only reduced errors and improved responsiveness but also positioned IIG Insurance to scale effortlessly while delivering greater value to their customers.

How can we help you?

Explore Our Solutions

Discover how Alfabolt's tailored services can help grow your business with innovative solutions.

Discover Our Expertise

Learn about the industries we specialize in and how we deliver impactful results across various sectors.

Learn from Real Results

See how we've helped businesses succeed through our case studies and effective solutions.